Airport Intelligence Series

The A321XLR – Network Catalyst or Widebody Killer?

January 2026

Historically, “Long-Haul” was an either-or choice: high-capacity widebodies for transoceanic routes or range-limited narrowbodies requiring technical stops. The A321XLR breaks this paradigm, acting as an instrument of “Hub Bypass” that fundamentally alters the risk profile of new route development. It liberates it to fly high-density trunk routes where its scale is an asset rather than a liability.

In this article, we deep dive into the economics of the inaugural route for the A321XLR by Indigo airlines.

The A321XLR Case Study:

IndiGo became the first Indian airline to induct an Airbus A321XLR. There are few more A321XLRs on the way in 2026 and it could be a gamechanger for the airline. The flexibility to deploy a narrowbody aircraft on thin long haul routes fits in well with the overall DNA of the airline.

Indigo recently commenced its first A321XLR route to Athens with service on different days from Delhi and Mumbai (rotation: BOM-ATH-DEL-ATH-BOM). The Delhi route bypassing Pakistan and Iranian airspace, adds another 90 minutes (or around 1,200 km) to the route, making it a very long narrow body flight. The current DEL-ATH route has a stage length of about 6,200 km / 3,360 nm or 8-hour 45 minutes block time (blue line in the exhibit below) and stretches the range of the A321XLR to almost the maximum with a full payload (3,700 nm+ the payload-curve starts dropping to allow for longer stage lengths). Reduced air densities during the summer season could result in payload penalties, should the current airspace situation remain unchanged.

The graphic above shows two routes for Delhi–Athens. The blue line is the longer route that Indigo currently operates on necessitated by the Pakistan and Iranian airspace closure, while the orange line shows the shorter path that a foreign flag carriers may use.

Though Indigo is the only non-stop service currently operating on the Delhi-Athens route, a foreign flag carrier would offer a distinctive advantage for European destinations (1,200 km or about 90 minutes of flight time on DEL-ATH route). This is what Aegean Airlines (A3), the flag carrier of Greece, is banking on apart from a lusher business class product. Aegean has announced a new service connecting DEL and ATH, starting in March 2026, with their brand-new XLRs.

For Indigo, bypassing Pakistan airspace adds roughly 1,200 km to the Delhi route. This extra distance eats into the A321XLR’s range and limits where it can be deployed. As a result, routes like Delhi–Milan, Delhi–Barcelona, Delhi–Paris, Delhi–Amsterdam, and Delhi–London are not feasible for the A321XLR without payload penalties. But Indigo is banking on connecting to these potentially high-density markets with the next batch of A321XLR deliveries.

With the current airspace closures, the A321XLR can fly to Athens and Rome and parts of Southern Europe, and Seoul, Tokyo, and Bali in East Asia. Going East maybe the better solution from an airline economics perspective in the near term. With the A350’s in the horizon for Indigo (first aircraft expected in 2027), the narrowbody route opener can also function as a non-seasonal back stop for the busier widebody operation during the peak season.

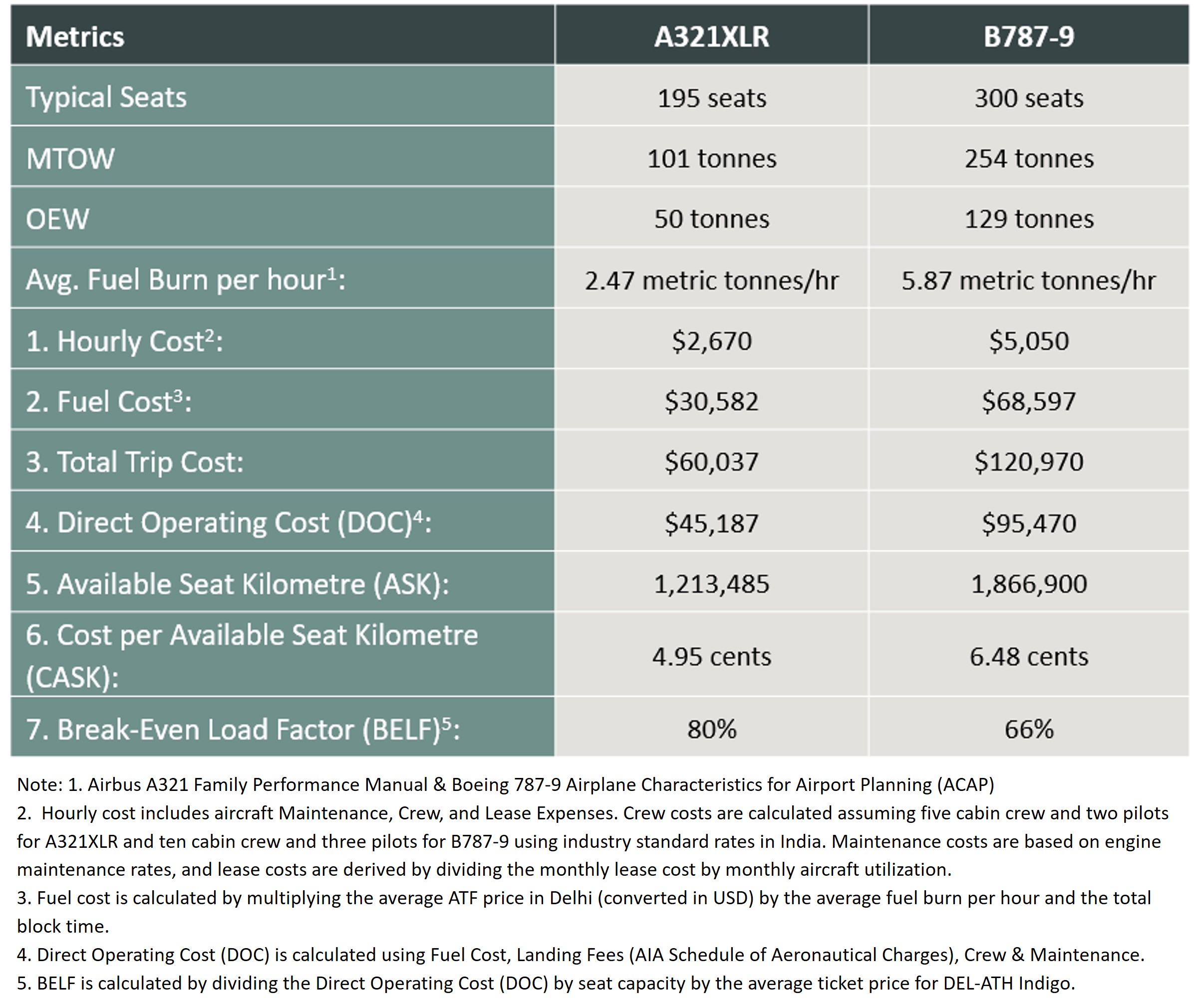

DEL-ATH Economics (6223 kms/3360 nautical miles)

Cost per Available Seat Kilometer (CASK) Benchmarks:

CASK provides the ultimate “efficiency score” for an airline’s operations:

- < 5 cents: Excellent Efficiency — Strong operational performance and fleet utilization

- 5–7 cents: Acceptable Range — Standard for many full-service carriers

- > 7 cents: Inefficiency Threshold — High risk of operational loss

The A321XLR offers some of the best cost economics in the industry for medium to long-haul operations, significantly lowering the revenue threshold required to break even. At IndiGo’s current competitive fares on the Delhi-Athens route —across 183 economy seats and 12 business-class seats—an 80% load factor is required to generate an operating profit (excluding overheads). This is obviously a metric that could be difficult to achieve all year-round, and the airline would look at raising prices at some point of time. Initial response appears to be robust with high load factors.

This reflects a classic market-entry strategy, with pricing positioned as a highly attractive value proposition to stimulate demand. If the demand surges (and assuming a more stable geopolitical environment), up-gauging to a widebody would require filling an additional 150+ seats to achieve route-level profitability.

The XLR isn’t meant to replace widebody planes. It’s a way for airlines to lower risk and test long-distance routes with fewer passengers. It makes it easier to start new long-haul routes that wouldn’t work with widebodies, but they are required for high-demand routes. It’s entry into commercial service reflects a structural shift in long-haul network planning rather than a simple extension of narrowbody range.

-

Share