Airport Intelligence Series

Sustainable Aviation Fuel: How prepared are we to meet industry targets?

Co-authored by Debayan Sen and Ira Gupta

August 2025

Introduction

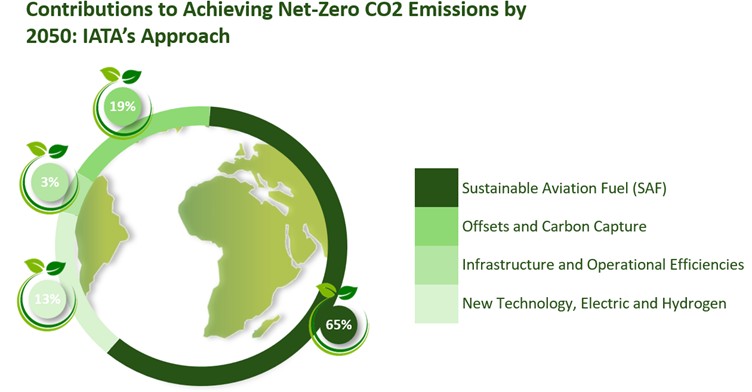

Airlines around the globe are committing to aggressive decarbonisation goals and to achieve net zero emissions by 2050. IATA estimates that Sustainable Aviation Fuel (SAF) is expected to be a key driver and could contribute ~65% of the reduction in emissions needed by the aviation sector to meet net zero ambitions.

In Europe, policy mandates are accelerating SAF adoption. The European Union’s ReFuelEU Aviation initiative has come into force on 1st January 2025 and requires a minimum SAF blend of 2%. This will rise to 6% by 2030, 20% by 2035, and 70% by 2050. Meanwhile, the United Kingdom has set its own SAF mandate which also commenced with a 2% blend in early 2025. This will gradually ramp up with at least 10% SAF by 2030 and a roadmap towards net zero aviation by 2050.

In 2024, global SAF production doubled in comparison to 2023 reaching 1.3 billion litres. However, this only accounted for 0.3% of the total global jet fuel production. The projected share of SAF for 2025 is 0.7% [1]. There is a long way to go before meeting industry targets and will need a significant ramp in production to ~7 billion litres annually.

There are 11 certified pathways to make feedstock for SAF and nearly half of the total market share for SAF is dominated by five large firms – Neste (Finland), Total Energies (France), World Energy LLC (UK), Eni (Italy) and OMV (Austria) [2].

India’s foray into SAF has been fairly recent compared to its global counterparts. A number of test flights were undertaken by airlines in 2018 and 2022. India is aiming for a 1 per cent SAF blend in ATF by 2027. The target will increase to 2 per cent in 2028 and reach 5 per cent by 2030 [3].

Challenges to adoption

- Regulatory framework: National mandates and regulations should be aligned with IATA timelines. Periodic review of progress is required at intermediate milestones.

- Increase in production infrastructure: To meet 2050 targets, IATA estimates that 3000- 6500 renewable fuel plants will be needed. In the short-term, existing refineries can be used to co-process up to 5% of approved renewable feedstocks alongside the crude oil streams.

- Pricing: SAF prices can be 2 to 10 times the conventional jet fuel depending on production volumes and the quantum of public subsidies [4]. This remains a key barrier. In the UK, a price cap of £1.50 (~US$2) for a single air fare has been introduced to cover the cost of SAF blending. However, in price-sensitive markets like India such a move could negatively impact passenger demand as well as airline profitability since aviation fuel can account for nearly 40% of operational costs.

- Supply reliability: Maintaining a consistent and affordable supply of SAF is necessary for wide-scale adoption. Airports may not need significant infrastructure upgrades but rather the focus must be on reliable supply chains, controlling logistics costs and quality checks.

- Skilled Manpower: SAF production incorporates highly technical processes that require specialized expertise in biofuel technology, chemical engineering and large-scale industrial processes. Fast-growing aviation markets such as India will require further investment in training and upskilling manpower.

Way forward

We believe the long-term outlook for SAF production is positive.

At a macro-level, meeting short-term milestones may be challenging without new production infrastructure. Interim solutions could include use of existing refineries to co-process approved renewable feedstock. In India, the newly signed MoU between IndianOil and Air India to supply ISCC-CORSIA-certified SAF—produced from used cooking oil, with an expected annual output of 35,000 tonnes [5], is a step towards early commercial partnerships. This venture will use repurposed infrastructure to kick-start real supply chains, reinforce demand certainty, and build momentum toward blending targets.

A pragmatic incentive scheme can also stimulate the supply chain and provide price stability in the initial years. The global nature of the aviation industry means that both mature and emerging markets need to work side by side to meet industry targets.

In recent times, SAF funds such as the Sustainable Aviation Fuel Financing Alliance (SAFFA) have emerged as a new category of sustainability-related investment vehicles in aviation. The airlines in India will need to get into the act and make bets to drive SAF investments. We understand that this is hard in an industry with thin margins. The risk can be shared by other players in the aviation ecosystem, such as companies that are looking beyond a target Internal Rate of Return to meet a broader range of sustainable, climate-conscious outcomes.

[1]https://www.iata.org and https://www.iata.org/en/pressroom/2025-releases/2025-06-01-02/

[2]https://www.marketsandmarkets.com/ResearchInsight/sustainable-aviation-fuel-market.asp

[3]https://www.constructionworld.in/transport-infrastructure/aviation-and-airport-infra/india-sets-saf-blending-targets-for-international-flights/

[4]DOE (USA) https://www.energy.gov/eere/bioenergy/sustainable-aviation-fuel-grand-challenge

[5]Indian Oil signs MoU with Air India for supply of sustainable aviation fuel – The Economic Times

-

Share